The Greatest Guide To Personal Insolvency

Table of ContentsGet This Report on Personal InsolvencyNot known Details About Bankruptcy The 15-Second Trick For Bankruptcy AustraliaUnknown Facts About Personal InsolvencyAbout Bankruptcy Victoria

As Kibler claimed, a business needs to have an actually great reason to reorganize a great reason to exist and also the rise of e-commerce has actually made retailers with huge store presences obsolete. 2nd opportunities might be a cherished American ideal, but so is innovation and also the growing discomforts that include it.Are you looking down the barrel of declaring yourself insolvent in Australia? This is no reason for someone leading you down the path of declaring insolvency.

We recognize that everyone deals with monetary pressure at some time in their lives. In Australia, also households and services that seem to be prospering can experience unexpected challenge as a result of life modifications, work loss, or factors that are out of our control. That's why, here at Leave Debt Today, we provide you professional recommendations and examinations concerning the true consequences of insolvency, debt contracts as well as other monetary concerns - we desire you to get back on your feet and stay there with the best possible outcome for your future and all that you wish to achieve.

What Does Bankruptcy Melbourne Do?

It deserves keeping in mind that when it comes to financial debt in Australia you are not the only one. Individual bankruptcies and insolvencies are at a record high in Australia, affecting 3 times as lots of Australian compared to twenty years ago. There is, nonetheless, no safety in numbers when it pertains to proclaiming personal bankruptcy and also bankruptcy.

One point that several Australian people are uninformed of is that in real truth you will certainly be noted on the Australian NPII for simply lodging an application for a debt agreement - Bankruptcy Victoria. Lodging a financial obligation contract is actually an act of proclaiming on your own bankrupt. This is a main act of insolvency in the eyes of Australian legislation also if your financial obligation collection agencies do not approve it.

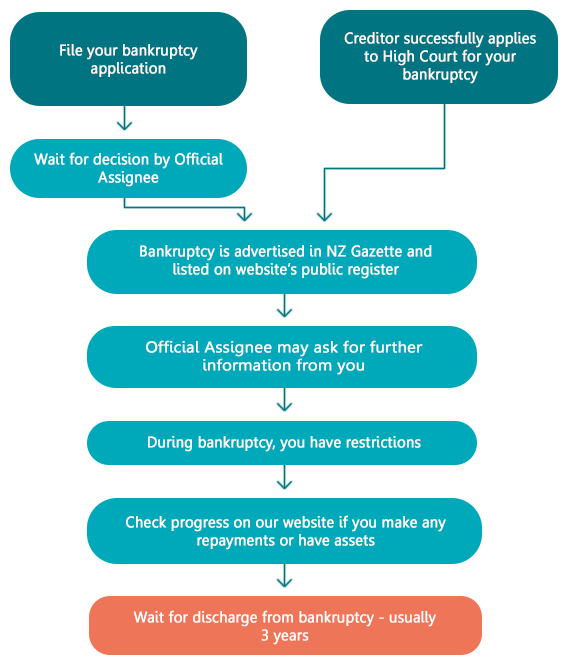

Throughout and also after your bankruptcy in Australia, you have specific commitments as well as face certain restrictions. Any kind of lenders who are wishing to obtain a copy of your credit record can request this details from a credit report reporting agency. As soon as you are stated insolvent secured financial institutions, who hold security over your building, will likely be entitled to take the property as well as market it.

See This Report on File For Bankruptcy

a house or vehicle) Once proclaimed insolvent you should inform the trustee instantly if you become the recipient of a deceased estate If any one of your creditors hold valid protection over any type of home as well as they act to recuperate it, you have to aid You should surrender your passport to the trustee if you are asked to do so You will certainly continue to be responsible for financial obligations incurred after the day of your personal bankruptcy You will will not have the ability to act as a supervisor or manager of a firm without the courts authorization As you can see participating in personal bankruptcy can have long-term negative results on your life.

Entering into insolvency can leave your life in tatters, shedding your home and possessions as well as leaving you with nothing. Prevent this end result by speaking to a financial obligation counsellor today about taking a different rout. Insolvency requires to be appropriately considered and also planned, you ought to not ever go into personal bankruptcy on a whim as it can have effects on you that you might not even be mindful of. Insolvency Melbourne.

We give you the capability to pay your financial obligation off at a decreased price and with lowered passion. We understand what creditors are searching for as well as have the ability to work out with them to give you the most effective opportunity to pay off your financial debts.

The Best Strategy To Use For Bankruptcy Advice Melbourne

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

What is the difference between default and insolvency? Back-pedaling a lending means that you've breached the promissory or cardholder contract with the lending institution to make settlements on time. Each loan provider has its very own requirements surrounding the amount of missed settlements you can have before visit the site it considers you in default. In many cases, that may be as low as one missed out on repayment or it can be as several as 9 missed repayments.

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

All about Bankruptcy Melbourne

If you default on an auto loan, the lender will certainly usually try to retrieve the automobile. Unprotected debt, like bank card cheap bankruptcy attorneys in my area financial obligation, has no collateral; in these instances, it's tougher for a debt collector to recoup the financial debt, however the agency might still take you to court and effort to place a lien on your house or garnish your earnings.

The court will appoint a trustee who might sell off or sell several of your properties to pay your lenders. While the majority of your debt will be canceled, you could select to pay some lenders in order to keep a vehicle or house on which the creditor has a lien, states Ross (Bankruptcy Victoria).

If you function in a sector where employers inspect your credit scores as component of the employing procedure, it might be a lot more tough to obtain a brand-new work or be advertised after bankruptcy. Jay Fleischman of Money Wise Law claims that if you have bank card, they will usually be closed as soon as you our website apply for bankruptcy.